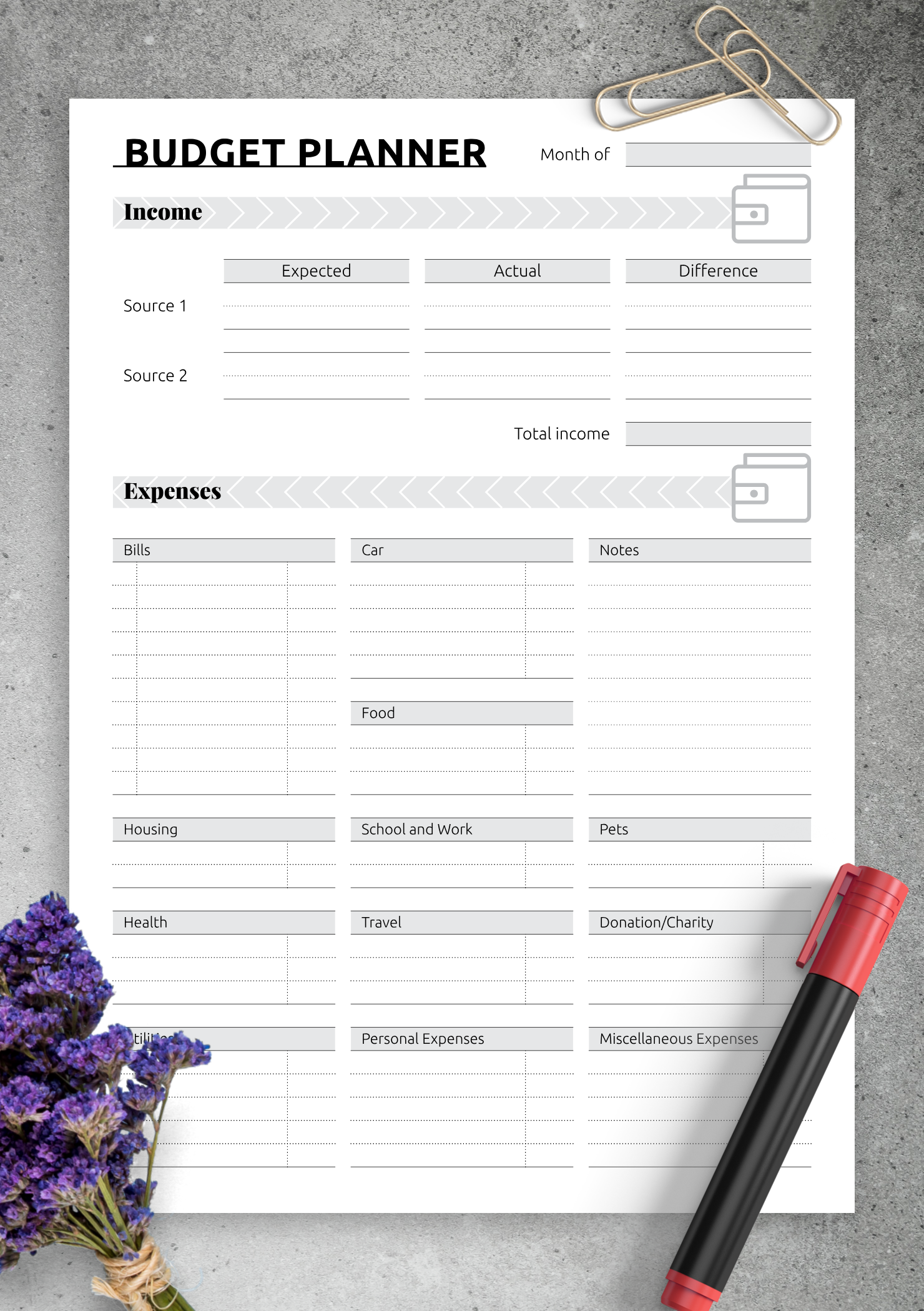

If you see any glaring omissions of your major spending categories, add them. To find the answer, let’s walk through this step by step. You’d think it would be easy to figure this out, right? Ha! It turns out this is one of the toughest questions in personal finance. Before you can do anything else, you’ve got to figure out how much these add up to. A good rule of thumb is that fixed costs should be 50% to 60% of your take-home pay. Step 3: Calculate your fixed costsįixed costs are the amounts you must pay, like your rent/mortgage, utilities, cell phone, and student loans. Now, let’s break down how to come up with your numbers for each category. Your spending doesn’t have to match these exactly, but I would be cautious about straying too far from these percentages. The percentages for each category outlined above are my recommended guidelines. Here is the collection of best printable budget templates broken down by categories (they are 100% FREE and downloadable, but may contain watermarks and uneditable).Vacations, gifts, house down payment, emergency fund, etc.ĭining out, drinks, movies, clothes, shoes, etc. But if you like to plan everything with pen and paper, then budget printables will be a perfect solution for you.

If you’re 100% digital person, you’re likely to google a smartphone app, excel templates or any other best online budgeting sites. When it comes to tools that can help you achieve that, there are plenty of mediums to choose from. A great advantage of having a budget is a possibility to track your spending habits over time and adjust them accordingly. It’s to help you plan for how, what for and how much money will be spent or saved during a particular period of time. A budget is a structured list of your personal or household expected income and expenses. Whatever you may need money for, it’s important that you stick to your budget day in and day out. You don't want to get a negative balance of your credit card, don't you? Moreover, keeping track of your finances can play an important role in the pace you improve your savings account balance and save money for your dream vacation, house or car. In the world of consumerism, it’s easy to spend a few bucks here and there to suddenly find out that you exceeded your daily, weekly or monthly budget. The ability to manage your cash flow and track your income and expense is vital.

Because it's not only business people who care about profits and expenses. It's no wonder why one of the many tips on personal finance management is to make budget.Īnd you don't have to be a financial specialist to do that.

What can be more important than time management? Correct.

0 kommentar(er)

0 kommentar(er)